How to change Registered Mobile Number in SBI online?

SBI (State Bank of India) now providing facility to change your mobile number

registered with your SBI account online without visiting the branch. To use

this facility, you must have SBI Internet banking facility and active ATM cum

Debit card. Using this facility, you can change your mobile number immediately

using Internet Banking. In this article, I will tell you how to change

registered mobile number in SBI online.

State Bank

of India (SBI) is one of the best and largest public sector banks in India. SBI

provides a lot of banking products and services to its customers. If you have discarded your old

mobile number and have taken a new one, then follow the below procedure to update the new number in your

SBI account.

How to change Registered Mobile Number in SBI online?

How to change Registered Mobile Number in SBI online?

Follow the below mentioned steps to change your registered mobile number

in SBI online

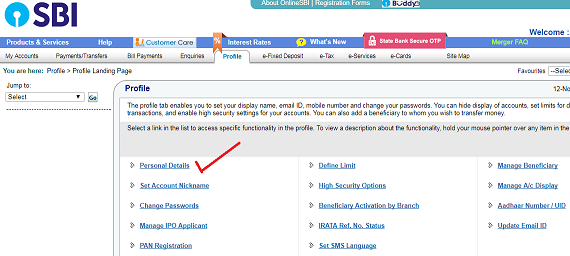

Step by step process

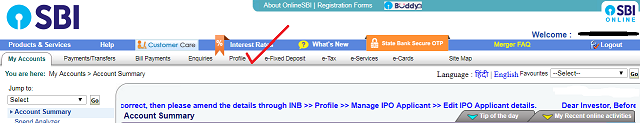

1. Visit OnlineSBI (https://retail.onlinesbi.com/retail/login.htm)

and login using your net banking user Id and password.

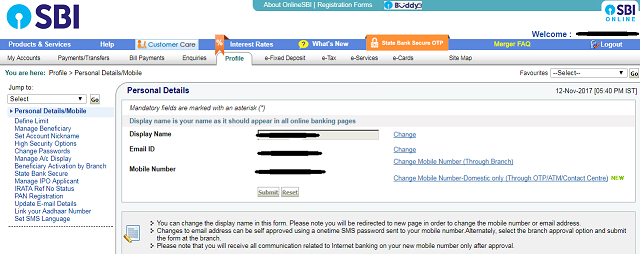

5. It will display your name, email Id and mobile number registered in SBI internet banking.

6. Here you have to click

on the link “Change Mobile Number-Domestic only (Through OTP/ATM/Contact

Centre)”.

7. A new screen with “Create Request” will appear, enter your “new mobile number”.

9. You will see a pop-up message as “Verify and confirm your mobile number xxxxxxxxxx” on the screen. To proceed, click “OK”.

10. In the next screen

you will see following three different options for approval of change of registered

mobile number in SBI online.

a) By OTP on both the

Mobile Number.

b) IRATA: Internet

Banking Request Approval through ATM.

c) Approval through

Contact Centre.

Change Registered Mobile Number in SBI online By OTP on both the mobile number

If you are having both

the old and new mobile number, then the registered mobile number change can be

approved online using OTP on both mobile number option.

1. Select the

option “By OTP on both the Mobile Number” and click on “Proceed” button.

2. Select your SBI account

for which you are holding the debit card and click on “Proceed” button.

3. In the next screen,

you will find the ATM cards associated with your SBI account. Select your ATM

card and proceed.

4. In the next

screen, you will see SBI’s Payment Gateway. Enter your card details like card number, expiry

date, holder's name, PIN and the characters visible in the box. Click on “Submit” button.

5. Verify and click

on “Pay” button.

6. After successful

validation, Internet Banking will send an OTP along with reference number on both

the mobile numbers (Old and new mobile number).

7. Now you have to

send SMS from both the mobile numbers (old and new mobile number) to 567676

within 4 hours in following format

ACTIVATE <8 digit

OTP value> <13 digit reference number> to 567676

e.g. ACTIVATE

12345678 UM12051500123

8. On successful

validation of the OTP and reference number, the new mobile number entered by

you will be copied in Internet Banking, CBS and ATM. You will also receive a successful

message in this regard on your mobile number.

You may also like to

read: SBI Recurring Deposit Account (RD Account)

You may also like to

read: SBI Quick – Missed Call Banking

You may also like to

read: Pay your Bills using SBI e-PAY service /Internet Banking

If you liked this article, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

How to change Registered Mobile Number in SBI online?