Are you looking to make money

through your social media accounts like Facebook, Twitter, YouTube, or Instagram?

In case your answer is “Yes” then this post is for you. In this post, I will be

introducing “Amazon Influencer Program” to you. Recently, Amazon has introduced

Amazon Influencer Program in India. Let’s look at how to join Amazon Influencer

Program with a qualifying Twitter, Facebook, YouTube, or Instagram account and

make money.

What is the Amazon Influencer Program?

The Amazon Influencer Program is

an extension to the online Associates

program for social media influencers. It is a monetization method that enables social

media influencers to make money by recommending products to their followers.

With Amazon Influencer Program, you get your own customized page on Amazon with

an exclusive vanity URL to showcase the products you recommend to your

followers.

How does the Amazon Influencer Program work?

The Amazon Influencer Program allows

you to create your own storefront on Amazon with a personalized URL to show the

products you recommend to your followers. Just promote your URL to make it

easier for your followers to shop your recommended products and earn money on

qualifying purchases.

Three simple steps to understand:

Three simple steps to understand:

1. Create your storefront - Crete

your own page on Amazon with a short and personalized URL and use it to

recommend thousands of products.

2. Share products - Use your exclusive

vanity URL to show the products you recommend to your followers, all in one

shoppable spot.

3. Get rewarded - When your followers’

shop through your storefront, you earn money on qualifying purchases.

Eligibility for joining Amazon Influencer Program

Anyone can join Amazon

Influencer Program. To be eligible for this program, you are required to have a

Facebook, Twitter, YouTube, or Instagram account. However, Amazon will look at

the number of followers and engagement metrics of your social media account

before approval. Amazon will also look at the type of content you post and its

relevancy for Amazon customers.

Today I tried to join this program with my Twitter account and was instantly approved. You can view my Amazon storefront Here.

How to join Amazon Influencer Program?

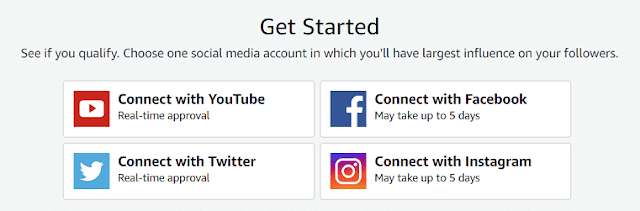

Visit Amazon Influencer Program page. Click on “Get

Started” to check if you are eligible or not for Amazon Influencer Program. Here,

you will see four different social media options to join this program as shown

in the image.

You need to choose one social media account in which you have the largest influence on your followers. If you apply with your Twitter or YouTube, you will get a response in real time. If you apply with Instagram and Facebook, then it may take up to 5 days.

Today I applied with my Twitter account and was instantly approved. You can click Here to view my Amazon storefront.

You need to choose one social media account in which you have the largest influence on your followers. If you apply with your Twitter or YouTube, you will get a response in real time. If you apply with Instagram and Facebook, then it may take up to 5 days.

Today I applied with my Twitter account and was instantly approved. You can click Here to view my Amazon storefront.

Next, you will see two options as in the image below.

If you are an existing Amazon Associate, then you can use your existing Associate account to register for the Influencer program. If you are not an existing Amazon Associate, then you need to create a new account for joining the program.

Click here to check if you qualify for this program. In case you don’t qualify now, you can come back in the future as the eligibility requirements may change over time. If you have qualified, then you can start creating your page right away.

How to get started?

Once approved for Amazon

Influencer Program, follow the steps given below to get started.

1. Complete setup. Just log

into to Amazon.in with the e-mail address. Type your vanity URL

(amazon.in/shop/YourHandle) into your

browser.

2. Create lists and add

products. Here you need to add products to your page by creating an Idea List.

3. Promote your page. Include

your vanity URL wherever you think it will help your followers to find the

products you recommend. For example social

media profiles or bios, video content, and individual posts.

4. Complete the payment and

tax information in your profile to ensure you receive payments.

Share your Amazon Influencer Link

Following are some ways for

sharing your storefront URL on various social networks to help you spread the

word about shopping on Amazon.

Twitter

1. Add a link in your Twitter bio line.

2. Include a link within Tweets.

Instagram

1. Add a link in your Instagram

bio line.

2. Include a link in

product-related posts.

3. Instagram stories

Facebook

1. Add a link in the “About”

section of your profile.

2. Facebook stories

3. Link the “Shop Now” button

to your influencer page.

4. Include a link in

product-related posts.

Website & Blog

1. Add links within blog posts.

2. Include links to specific

products that you write about.

YouTube

1. Add link in the “About”

section of your YouTube channel.

2. Add a link in the

description of your videos.

3. Mention your URL during

your video and include a banner ad to your influencer page.

Snapchat

1. A teaser about your shop on

Amazon.

Podcasts

1. Tell your fans about your

shop on Amazon.

The Amazon Influencer Program can

be a great opportunity to make money online by monetizing your Facebook, Twitter,

YouTube, or Instagram Account. So, give it a try. Click here to get started

with the Amazon Influencer Program.

Also read: How to become an LIC Agent / Advisor?

Also read: Ways to make extra money

Also read: 7 Habits that can make you rich

Also read: How to set your financial life in order?

If you liked this article, share it with your friends and colleagues trough social media. Your opinion matters, please share your comments.

Also read: How to become an LIC Agent / Advisor?

Also read: Ways to make extra money

Also read: How to set your financial life in order?

If you liked this article, share it with your friends and colleagues trough social media. Your opinion matters, please share your comments.