HDFC Bank, one of the leading

private sector banks in the country, has launched its Digital Loan Against Mutual

Funds (LAMF), in partnership with mutual fund transfer agent CAMS. HDFC Bank is

one of the first to offer, Digital Loan Against Mutual Funds (LAMF).

In this

post, let’s take a look at how to avail HDFC Digital Loan Against Mutual Funds (LAMF).

What is Digital Loan Against Mutual Funds (LAMF)?

Digital Loan Against Mutual

Funds (LAMF) is an instant facility offered by Once you apply for LAMF, an

overdraft limit will be set in your account in just 3 minutes. With

this facility, now you can enjoy the benefits of instant availability of funds, retention of mutual fund returns

without liquidation or stopping your SIPs.

Benefits of HDFC LAMF

Following are the key benefits of

1. The LAMF facility is available across

the country on HDFC Bank website.

2. There is no need to sell

your best performing mutual funds instead you can use LAMF facility.

3. Instant online approval

of the loan in few minutes.

4. The loan is available against both debt & equity mutual funds.

5. No need to visit bank branch as the entire process online.

6. First-time borrowers without credit history can also access loans.

7. New loans and enhancements

can be done online any time.

8. Interest is applicable only on the utilized amount.

Also read:

Also read:

HDFC utual Funds

HDFC Digital

Loan Against Mutual Funds is offered against both equity and debt mutual funds offered by

following

1. Aditya Birla Sun Life Mutual Fund

2. DSP Black Rock Mutual Fund

3. HDFC Mutual Fund

4. HSBC Mutual Fund

5. ICICI Prudential Mutual Fund

6. IDFC Mutual Fund

7. IIFL Mutual Fund

8. Kotak Mutual Fund

9. L&T Mutual Fund

10. Mahindra Mutual Fund

11. PPFAS Mutual Fund

12. SBI Mutual Fund

13. Shriram Mutual Fund

14. Tata Mutual Fund

15. Union Mutual Fund

Purpose of HDFC LAMF

Please also note that Digital Loan Against Mutual

Funds is

granted only for personal purposes only. The loan amount cannot be used for the

following purposes.

1. For speculative

activities.

2. For any purpose linked to

capital market activities.

3. For any anti-social

purposes.

Interest Rate for HDFC LAMF

Annual Percentage Rate applicable for

1. Equity Mutual Funds

Min APR – 9.25%

Max Apr – 11.14%

Avg APR – 10.32%

2. Debt Mutual Funds

Min APR – 7.95%

Max APR – 10.62%

Avg APR – 9.71%

Annual Maintenance Charges

- Minimum Rs. 1000

- Maximum Rs. 5000

Processing Fees

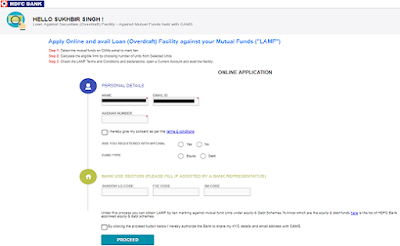

How to avail HDFC Digital Loan Against Mutual Funds?

Step by step instructions to avail HDFC Digital Loan Against Mutual Funds is given below.

2. Enter your HDFC customer Id and mobile number.

4. Enter your Aadhaar number and, click on box to accept terms &

conditions.

5. Select “Yes” or “No” option against “Are you registered with MyCAMS”.

6. Select mutual fund types (Equity or Debt).

7. Authorize HDFC bank to share your KYC details and email id with CAMS.

9. Now you

will be redirected to MyCAMS website.

10. If you are not registered with MyCAMS then you

have to register yourself on MyCAMS. If you are already registered with MyCAMS

then just login using your password.

11. Now select the mutual funds to mark lien.

12. Calculate the eligible limit by choosing number of

units from selected units.

13. Check LAMF terms & conditions and declaration.

14. Enter your One Time Password (OTP) to activate

overdraft facility to use in your account.

Also read: How to pay HDFC Credit Card bills?

Also read: HDFC SmartBuy E-commerce Platform

Also read: How to block HDFC Debit Card?

Also read: HDFC Bank EasyKeys

If you liked this article, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

HDFC Digital Loan Against Mutual Funds (LAMF)

Informative post. What about loan against HDFC Life policy? Your list did not cover that fund.

ReplyDeleteThanks Abhijit for suggesting this topic.

Delete