What is Form 26AS | How to view and download Form 26AS

The due date for filing income tax return is 31st July. Your

Form 26AS is one of the most important documents

required while filing income tax return (ITR).

It is your tax credit statement which shows all taxes received by the Income Tax Department against your PAN number during the financial year. In this post, let's see what all details this form contains and how to view and download Form 26AS.

It is your tax credit statement which shows all taxes received by the Income Tax Department against your PAN number during the financial year. In this post, let's see what all details this form contains and how to view and download Form 26AS.

What is Form 26AS

It is the annual

consolidated tax credit statement issued to PAN holders. This statement

shows all the taxes received by the Income Tax Department against the PAN of

the taxpayer during the financial year.

It includes details of all the taxes deducted from

your income by your employer, bank etc.

Form 26AS statement

The statement contains

the following details.

1.

Details of the tax deducted at source.

2.

Details of the advance tax or self-assessment tax paid.

3.

Details of the tax collected at source.

4.

Details of the refund received from tax department during the financial year.

5. Details

of Annual Information Return (Details of high-value transactions).

Therefore,

always view and download Form 26AS for any discrepancies before filing your

income tax return (ITR) for the year.

How to view and download Form 26AS

There

are two ways to view and download Form 26AS.

1.

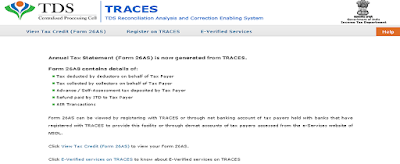

View and download through the TRACES (TDS Reconciliation

Analysis and Correction Enabling System) website.

2.

View through Net Banking facility of authorized banks.

View and download Form 26AS through the TRACES website

Step

by step instructions to view and download it from TRACES website.

Step

1

Go

to the income tax department’s e-filing website www.incometaxindiaefiling.gov.in and

log in using your login Id and password.

If you do not have an account, you will have to register yourself on the income

tax department's website (www.incometaxindiaefiling.gov.in).

You have to fill your PAN number, name, and date of birth and choose a

password. Once your registration is complete, you can log in to your account with your user

ID and password. Your permanent account number will be your user ID.

Step

2

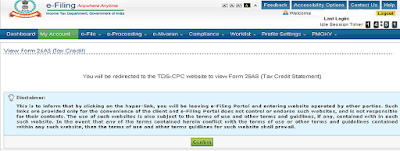

Go

to “My Account” and click on “View Form 26AS (Tax Credit)” in the drop-down

menu.

Step

3

Click

on “Confirm” button so that you will be redirected to the TDS-CPC (TRACES)

website to view Form 26AS (Tax Credit Statement)

Step

4

Now

you are on TDS-CPC (TRACES) website. Select the small box to agree to the usage

and acceptance of Form 16 / 16A generated from TRACES. Click on “Proceed”

button.

Step

5

Now

click on the View Tax Credit link at the bottom of the page to view

your Form 26AS.

Step

6

Choose

the year for which you want to view/download your Form 26AS under the

“Assessment Year” drop-down menu. Choose the file format in which you want to

view your Form 26AS under the “View As” drop-down

menu. If you want to see it online, choose the file format as HTML. If you want

to download it, choose PDF. After choosing the file format, enter the

“Verification Code” and click on “View / Download”.

Step

7

To

open the downloaded document you will require a password. The password for this

is your date of birth in DDMMYYYY format.

View

Form 26AS through Net Banking of your bank account

You

can also view your Tax Credit Statement through Net Banking facility. However, you can view this form using this facility if

your PAN number is

linked to your bank account. This facility is available free of cost but only

select banks are authorized to provide it.

List

of banks authorized to provide this facility are as below

2. Andhra Bank

7. Canara Bank

10. City Union Bank Limited

11. Corporation

Bank

12. Dena Bank

16. Indian Bank

18. IndusInd Bank

20. Karnataka Bank Limited

25. State Bank of India

26. Syndicate

Bank

30. UCO Bank

33. Vijaya Bank

34. Yes Bank

Limited

Hope now you will be able to view and download Form 26AS online easily before filing your income tax return. Ideally, you should check it regularly after every few months. This way you will get enough time to get it corrected with the tax deductors if there are any errors.

You

may also like to read: How to file income tax return online?

You

may also like to read: Documents needed while filing income tax return in India

You

may also like to read: Most common mistakes people make while filing income tax return

You

may also like to read: Small business ideas with low investments

If you liked this article,

share it with your friends and colleagues through Twitter or Facebook. Your

opinion matters, please share your comments.

Does not work for NRI customers. Download request is submitted but downloadng document is broken

ReplyDeleteVery helpful info.

ReplyDeleteThanks Jyotirmoy !

Delete