The due date for filing income tax return is 31st July. If you have all your documents in place, you can now file your tax return online, as all the ITR forms are accessible online at the income tax department’s e-filing website (www.incometaxindiaefiling.gov.in). Please note that only ITR 1 SAHAJ and ITR 4 SUGAM can be filled via the fully online process. In this post, let us take a look at how to file your income tax return (ITR) online.

How to file your income tax return (ITR) online?

Follow the below steps and

file your return online.

Step 1

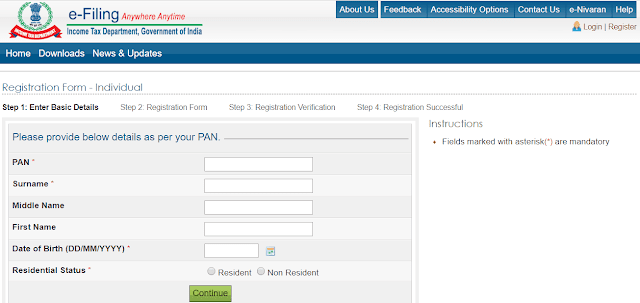

To file your return online,

you need to register yourself on the income tax department's website.

You need to fill your PAN number, name and date of birth and choose a password.

Once your registration is complete, you can log in

to your account with your user ID and password. Your permanent account

number will be your user ID.

Step 2

Step 3

Keep the documents ready

such as PAN card, Form-16, Form-16A, statements of all bank

accounts or passbooks, interest income statement for fixed deposits, Form 26AS, investments proof under Section 80C, home loan details and interest

certificates, stock trading statement, advance tax payment challan, medical insurance

receipts, etc. Click here to read: Documents needed while filing tax returns in India.

Step 4

There are two ways you can

file your tax return online.

1. Partially offline process

2. Fully online process.

Partially Offline Process

2. Go to the download section

and click on “IT Return Preparation Software” option.

6. Login to the

e-filling website with your Id and password.

7. Go to “e-file” and click

on “Income Tax Return” option.

8. Next screen, you need to

select assessment year, ITR Form number, Filing Type and submission mode. Here

select submission mode as “Upload XML”.

9. Select an option to verify

your income tax return. Click on “Continue” tab.

11. Upload digital

signature, if applicable.

12. Now click on the “Submit”

button.

Fully Online Process

2. Login with your Id and

password.

4. Next screen, you need to select

assessment year, ITR Form number, Filing Type and submission mode. Here select

submission

mode as “Prepare and Submit Online”. (Please note that only ITR 1 and ITR 4 can

be filled online). Click on “Continue” tab.

5. Fill all the details and

click on “Preview & Submit” button.

6. Upload digital signature,

if applicable.

7. Now click on the “Submit”

button.

Step 5

On successful submission of

your ITR form, an acknowledgment number is generated if the return is submitted

using the digital signature. Your tax return filing process is complete. Just

preserve this number.

An ITR-V is generated if the

return is submitted without digital signature. ITR-V will also be sent to the

registered email. The ITR-V form should be printed, signed and submitted to the

CPC within 120 days from the date of e-filing. Check your emails/SMS for

reminders on non-receipt if ITR-V.

Step 6

You can e-verify your return

through electronic verification by using the e-verify return option on the

website. You can also use Net banking, Aadhaar

OTP, pre-validated bank account, bank ATM and pre-validated Demat account to e-verify

your return. E-verification eliminates the need to send ITR-V to CPC.

Hope now you will be able to

file income tax return (ITR) online easily.

You may also like to

read: 10 Tax saving options other than Section 80C

You may also like to

read: Tax saving options and plans

If you liked this article,

share it with your friends and colleagues through social media. Your

opinion matters, please share your comments.

Very helpful and informative. Thank you.

ReplyDeleteThanks for your appreciation.

DeleteNice post on IT e-filing

ReplyDeleteThanks!

DeleteNice information.

ReplyDeleteThanks for the appreciation!

DeleteI read over your blog, and i found it inquisitive, you may find My Blog interesting. So please Click Here To Read More About

ReplyDeleteTop Audit firms in Mumbai

GST Consultant in Mumbai

Statutory audit service

Taxation Regulatory & Advisory Services

Tax consultant in Mumbai

International tax consultant Mumbai

Top CA Firm in Mumbai

Tax Return Preparation

ReplyDeleteIf you want to prepare an income tax return filing for your business, then Ajas.com.au help you for income tax return filing preparation. Contact us - 0412 441 570

to get more - https://ajas.com.au/taxation/

Tax Return Preparation

ReplyDeleteIf you want to prepare an income tax return filing for your business, then Ajas.com.au help you for income tax return filing preparation. Contact us - 0412 441 570

to get more - https://ajas.com.au/taxation/

wow. this is really very very helful for who pay tax. all the steps are clearly mentioned. For more details contact GST Consultants In Andheri Mumbai.

ReplyDeleteLooking for ITR Filing Agents in Mumbai? Find the best Income Tax Return Filing Consultants in Mumbai ITR Filing in Mumbai Call Experts at +91-9719586772 or Contact us now!

ReplyDeleteits very useful post for the people who paying taxes.very thank you for posting.

ReplyDeleteincome tax return services

Thanks for sharing such a nice post of Income Tax Return. Its help to choose a right income tax filing agents in delhi India. Keep sharing.

ReplyDeleteGratitude for the excellent insight. Visit Vakilsearch site to itr 3 form

ReplyDeleteNice post

ReplyDeletexyz

Valuable information! Looking forward to seeing your notes posted for more info: Accountants in Melbourne

ReplyDeleteAmazing information about the Online ITR Filing India India. Keep sharing and one again for this valuable post

ReplyDeleteThere are many question arises in the mind why should file return or what are the benefits of filing Income Tax Returns. After these two question is how to file ITR online? If you really want to file ITR and know every thing about the NCOME TAX RETURN. Just go through this blog to know everything - INCOME TAX RETURN – AN OVERVIEW

ReplyDeleteGratitude for the excellent insight. Visit Vakilsearch site to file a itr 3 form

ReplyDelete