India’s leading private insurer,

HDFC Life, has launched HDFC Life Sanchay Plus Plan. The plan is designed to

eliminate uncertainties from financial planning by providing a guaranteed

income. It comes with multiple benefit options and offers guaranteed payouts. In

this post, let us take a look at HDFC Life Sanchay Plus Plan features and

benefits.

HDFC Life Sanchay Plus Plan

This is a traditional insurance

plan with some different features. The policy is a non-participating and a non-linked

savings insurance plan. That means guaranteed returns for you and your family. This

insurance plan offers a savings component together with the insurance cover for

your total benefit.

Eligibility for this Insurance Pilocy

Here is a snapshot from the

product brochure about the eligibility criteria for this policy.

HDFC Life Sanchay Plus Plan – Features

This insurance plan comes

with multiple benefit options. The key features of this insurance policy include

the following:

1. Guaranteed benefits.

2. Flexibility to choose

guaranteed benefits as a lump-sum benefit or as regular income.

3. With Life Long Income

option, you get guaranteed regular income until 99 years of age.

4. With Long Term Income

option, you get guaranteed regular income for a pre-fixed term of 25 to 30

years.

5. Life Long and Long Term

Income options return the total premiums paid at the end of the payout period.

6. Enhanced benefit for

policies with Annual Premium more than Rs.150,000.

7. You will get tax benefits

as per prevailing tax laws under Sections 80C and 10D of IT Act, 1961.

8. You can enhance your

protection cover with additional riders on payment of additional premium.

HDFC Life Sanchay Plus Plan Variants

This insurance policy comes

in four variants

1. Guaranteed Maturity

In this option, you will get

guaranteed benefit payable as a lump sum at maturity. See the below chart

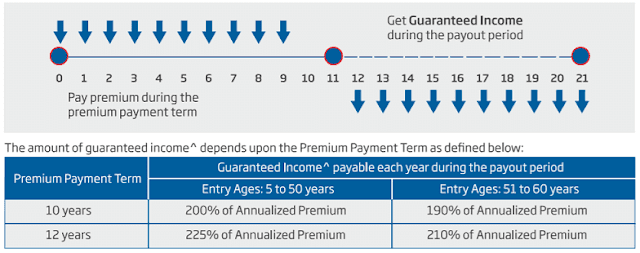

2. Guaranteed Income

In this option, you will get

maturity benefit in the form of guaranteed income for a fixed term of 10 or 12

years. See the below chart

3. Life Long Income

In this option, you will receive

the maturity benefit in the form of guaranteed income until 99 years of age and

return of premiums paid at the end of the payout period. See the below chart

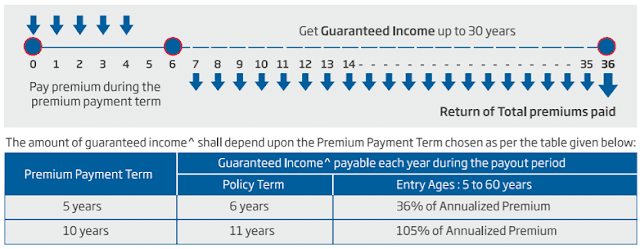

4. Long Term Income

In this option, you will

receive the maturity benefit in the form of guaranteed income from a term that

ranges from 25 to 30 years and the return of premiums paid at the end of the payout

period. See the below chart

Death Benefit under this Policy

The death benefit is the

same for all the variants and is payable only in case of death of the

policyholder during the policy term.

Sum Assured on death is the

highest of the following:

1. 105% of the total premium paid

2. 10 times the annualized premium

3. The guaranteed sum assured on maturity

4. An absolute sum to be paid on death, which is equal to the sum assured.

1. 105% of the total premium paid

2. 10 times the annualized premium

3. The guaranteed sum assured on maturity

4. An absolute sum to be paid on death, which is equal to the sum assured.

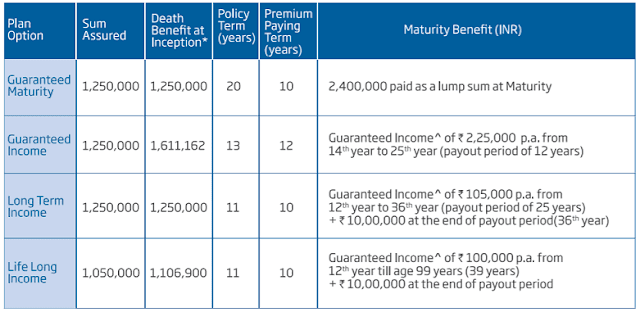

Sample Illustration of Benefits

Illustration of benefits for

a healthy male aged 30 years (50 years for Life Long Income Option), who pays annual

premium Rs 1 lakh + GST per throughout the premium paying term and survives the

policy term.

Why you need HDFC this Insurance Policy?

1. There are guaranteed

benefit payouts under this policy.

2. It provides life cover to

protect your family's future.

3. You will be eligible for

tax benefits.

Premium Paying Term and Policy Term

See the below chart for the premium

paying terms and policy terms respectively.

The Premium Frequency Available under HDFC Life Sanchay Plus Plan

The premiums can be paid

annually, half-yearly, quarterly and monthly.

If you liked this article,

share it with your friends and colleagues through social media. Your opinion

matters, please share your comments.

No comments:

Post a Comment