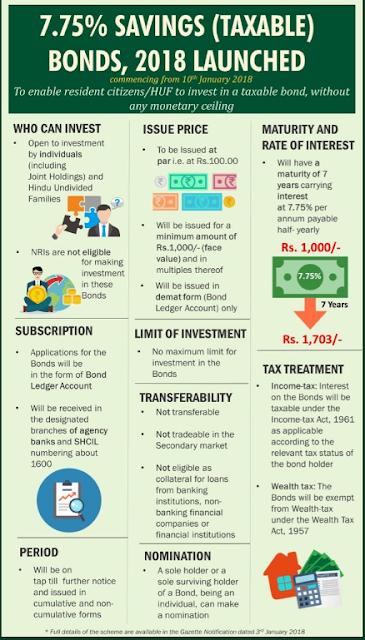

The Government of India has announced the launch of 7.75% Savings (Taxable) Bonds Scheme, 2018, which will replace the 8% Savings Bonds Scheme. The 7.75% Government Savings Bonds will open for subscription from January 10, 2018. The bonds will have a maturity of seven years. The scheme will enable resident citizens and HUF (Hindu Undivided Families) to invest in a taxable bond without any monetary ceiling. The 7.75% Government Savings Bonds will be available in denominations of Rs 1,000 each and will only be issued in demat form and credited to the Bond Ledger Account (BLA) of the investor. In this article, I will discuss all the things you should know about 7.75% Government Savings Bonds 2018.

Who issues these Bonds?

7.75% Government Savings Bonds 2018 are being issued by the Government of India.

Who can invest in 7.75% Government

Savings Bonds?

The 7.75% Government Savings

Bonds may be held by

1. Individuals (including joint holdings

and on behalf of a minor as father/mother/legal

guardian).

2. A Hindu Undivided Family

(HUF).

NRIs are not eligible for

making investments in 7.75% Government Savings Bonds.

Issue price of 7.75 Government Savings Bonds

1. The Bond will be issued

at par i.e. at Rs. 100.00.

2. The Bonds will be issued

for a minimum amount of Rs. 1,000 (face value) and in multiples thereof.

Accordingly, the issue price will be Rs 1,000 for every `1,000 (Nominal) face

value.

3. The Bonds will be issued in

demat form and credited to the Bond Ledger Account (BLA) of the investor.

Also read: 7 Habits that can make you rich

Also read: 7 Habits that can make you rich

Limit of investment in 7.75% Government Savings Bonds

You can invest a minimum of

Rs 1,000 and in multiple thereof .There is no maximum limit for investment in these

Bonds.

Maturity Period of 7.75% Government Savings Bonds

The 7.75% Government Savings Bonds will have

a maturity of 7 years.

Where to buy 7.75%

Government Savings Bonds?

You can

buy 7.75%

Government Savings Bonds from State Bank of India, Nationalized Banks

and private sector banks such as Axis Bank, ICICI Bank and HDFC Bank. These

bonds can also be bought from the offices of Stock Holding Corporation of India

Ltd (SHCIL) as well.

Also read: Money Saving Tips

Also read: Money Saving Tips

Rate of Interest and Interest Payment Options

1. The 7.75% Government Savings Bonds will be

issued in ‘Cumulative’ or ‘Non-cumulative’ form.

2. The 7.75% Government Savings Bonds will bear

interest at the rate of 7.75% per annum.

3. Non-cumulative Bonds:

Interest will be payable at

half-yearly.

4. Cumulative Bonds:

a) Interest will be

compounded with half-yearly rests.

b) The cumulative value of

Rs. 1,000 at the end of seven years will be Rs 1,703.

Taxation of 7.75% Government Savings Bonds

1. Interest on the 7.75% Government Savings Bonds will be taxable as per

your income tax slab rate. Tax will be deducted at source (TDS) while

making payment of interest.

2. The Bonds will be exempt from wealth-tax under the Wealth Tax Act,

1957.

Transferability of 7.75% Government Savings Bonds

The 7.75% Government Savings Bonds held to the credit

of Bonds Ledger Account (BLA) of an investor shall not be transferable.

Advances/ Tradability against Bonds

The 7.75% Government Savings Bonds shall not be

tradable in the secondary market and shall not be eligible as collateral for

availing loans from banks, financial Institutions and Non-Banking Financial

Companies.

Nomination under 7.75% Government Savings Bonds

1. A sole holder or all the

joint holders of a Bond can make a nomination.

2. The investor can make

separate nomination for each investment.

3. No nomination shall be

made in respect of the Bonds issued in the name of a minor.

4. A nomination made by a

holder of a Bond can be changed by a fresh nomination.

5. If the nominee is a minor,

the holder of Bonds may appoint any person to receive the amount due in the

event of his / her / their death during the period the nominee is a minor.

Also read: What is NPS (national Pension System)?

Also read: National Savings Certificate (NSC)

Also read: Post Office Small Savings Schemes

Also read: How to invest in mutual funds online?

If you liked this article, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

Also read: What is NPS (national Pension System)?

Also read: National Savings Certificate (NSC)

Also read: Post Office Small Savings Schemes

Also read: How to invest in mutual funds online?

If you liked this article, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

7.75% Government Savings Bonds 2018

No comments:

Post a Comment