HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

HDFC Life Click 2 Protect 3D

Plus is a non-linked non-participating term insurance plan. HDFC Life Click 2

Protect 3D Plus is an online term

insurance plan. Being a term insurance plan, it offers a comprehensive financial

security at an affordable price and protects your loved ones against the

uncertainties of life. In this post, let’s understand the features &

benefits of HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan.

HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

HDFC Life Click 2

Protect 3D Plus is a term insurance plan that offers large cover at low

premiums. 3D stands for the three uncertainties that we face at some

point in time, i.e. Death, Disability, and

Disease. HDFC Life Click 2 Protect 3D Plus | Online Term Insurance Plan offers

a wide range of 9 plan options to help you choose as per your need. With the

wide range of plan options, HDFC Life Click 2 Protect 3D Plus is an ideal online

term insurance plan for you.

Also read: Why do you need life insurance?

Also read: Why do you need life insurance?

Features of HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

1. HDFC Life Click 2 Protect

3D Plus provides financial protection to you and your family at an affordable price.

2. You can customize your

plan with a choice of 9 plan options.

3. All future premiums are

waived on Accidental Total Permanent Disability (available under all options)

and on the diagnosis of Critical Illness

(Available with 3D Life and 3D Life Long

Protection options).

4. You can protect yourself

for the whole of life with lifelong

protection option.

5. You can choose your

policy and premium payment terms.

6. You can increase your insurance

coverage every year through top-up option.

7. Life Stage Protection

feature offers to increase insurance cover on certain key milestones without

medicals.

8. Attractive premium rates

for non-tobacco users.

9. There are special premium

rates for female lives.

10. You can avail tax

benefits as per existing tax laws.

Also read: Term insurance | How to choose term insurance?

Also read: Term insurance | How to choose term insurance?

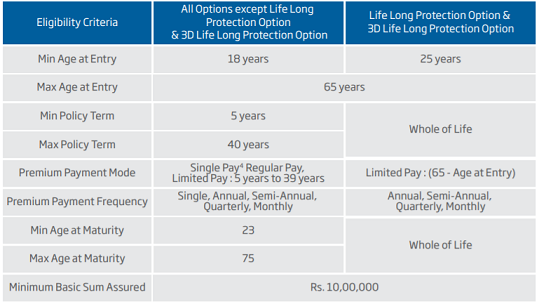

Eligibility conditions for HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

Plan options available under HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

The following 9 plan options available with HDFC

Life Click 2 Protect 3D Plus Policy namely:

1. Life Option

2. 3D Life Option

3. Extra Life Option

4. Income Option

5. Extra Life Income Option

6. Income Replacement Option

7. Return of Premium Option

8. Life Long Protection

Option

9. 3D Life Long Protection Option

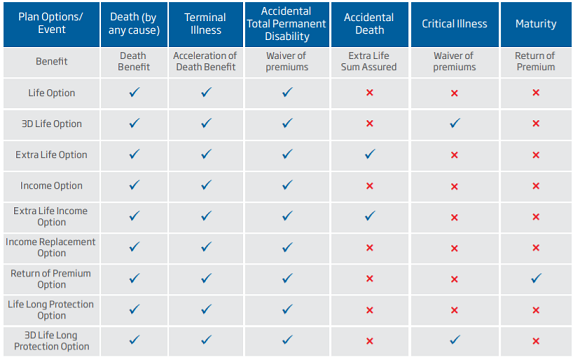

Benefits under HDFC Life Click 2 Protect 3D Plus Policy | Online Term Insurance Plan

All the plan options and their respective

benefits are given in the table below

Death Benefit

Death Benefit is the sum of:

Sum Assured on Death AND Additional

Benefits

Sum Assured on Death is

defined as:

1. For Single Pay Policies

Highest of: a) 125% of the single premium.

b) Guaranteed sum assured on

maturity.

c) Absolute amount assured

to be paid on death.

2. For Regular Pay &

Limited Pay Policies

Highest of: a) 10 times of the annualized premium.

b) 105% of total premiums paid.

c) Guaranteed sum assured on

maturity.

d) Absolute amount assured to

be paid on death.

Why you need HDFC Life Click 2 Protect 3D Plus Policy?

1. HDFC Life Click 2 Protect 3D Plus Policy provides

financial security at an affordable price.

2. This online term insurance plan ensures that your

family has comprehensive security always.

3. It will maintain the family’s standard of living

even in your absence.

4. HDFC Life Click 2 Protect 3D Plus Policy covers

against the 3 uncertainties - death, disease, and

disability.

If you liked this article, share it with your friends

and colleagues through social media. Your opinion matters, please share your

comments.

HDFC Life Click 2 Protect 3D

Plus Policy | Online Term Insurance Plan

No comments:

Post a Comment