SBI Scholar Loan Scheme | SBI Education Loan

State Bank of India

(SBI), the country’s biggest public sector bank provides various types of

educational loans to students who are Indian national to pursue higher studies

in India or at a foreign institution. SBI offers the following education loan

schemes

2. Scholar loan

scheme

3. Skill loan scheme

5. Takeover of education loan

In this article, let

us take a look at all details like eligibility, loan amount, security, repayment

that you need to know about SBI scholar loan scheme.

SBI Scholar Loan Scheme

SBI scholar loan scheme is offered to students who are Indian National and have secured admissions in select premier institutions (IIT, NIT, IIM, AIIMS etc.) of the country for pursuing higher education.

SBI scholar loan scheme provides 100 percent financing without any processing fee. The repayment period of SBI scholar loan is up to 15 years after course period plus 12 months of repayment holiday.

Quick sanction of a loan under this scheme, at designated campus branch or more than 5000 selected branches of SBI all over the country.

SBI scholar loan scheme provides 100 percent financing without any processing fee. The repayment period of SBI scholar loan is up to 15 years after course period plus 12 months of repayment holiday.

Quick sanction of a loan under this scheme, at designated campus branch or more than 5000 selected branches of SBI all over the country.

Eligibility for SBI Scholar Loan Scheme

1. The applicant should be an Indian national.

2. He/she should have secured admission to professional/technical

courses in select premier institutions (IIT, NIT, IIM,

AIIMS etc.) of the country through

entrance test/selection process.

Courses covered under SBI Scholar Loan Scheme

1. Regular full-time

degree or diploma courses through merit-based

entrance test or selection process.

2. Full-time executive management courses

like PGPX.

3. Certificate or part-time

courses are not covered under this loan.

Expenses covered under SBI Scholar Loan Scheme

1. Fees payable to college/school/hostel.

2. Examination, library or laboratory fees.

3. Purchase of books, equipments

or instruments.

4. Caution deposit, building fund or refundable deposit (maximum 10% of

tuition fees for the entire course).

5. Travel expenses or expenses on exchange

programme.

6. Purchase of computer or laptop.

7. Other expenses related to education.

In case of a married person,

co-obligator can either be husband/wife or parent or parent-in-law. Parental

co-obligation can also be substituted by a suitable third party guarantee.

Repayment of SBI Scholar Loan Scheme

1. The repayment period of SBI scholar loan is up to 15 years after course

completion period plus 12 months.

2. If the second loan is availed for higher studies later the repayment

period for the combined loan amount is 15 years after completion of the second course.

Rate of Interest for SBI Scholar Loan Scheme

Documents Required for SBI Scholar Loan Scheme

1. Loan application

form

2. Letter of admission

3. Two passport size photographs

4. Statement of cost of study

5. PAN card of the student and parent or guardian

6. Aadhaar card of the student and parent or guardian

7. Proof of identity (Aadhaar, driving licence, passport, or any photo identity).

8. Passport, driving licence,

telephone bill or electricity bill as proof of residence.

9. Bank account statement of student/co-borrower/ guarantor's for last 6

months.

10. IT return of previous 2 years of parent or guardian or other

co-borrower (if IT Payee).

11. A brief statement of assets and

liabilities of parent or guardian or other co-borrower.

12. Proof of income of parent or guardian or other co-borrower.

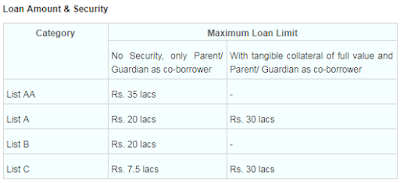

SBI scholar loan scheme is offered to students who are Indian national and have secured admissions at select leading institutions of the country like IITs, IIMs, NITs, AIIMS and other premier institutions. Loan amount under SBI scholar loan scheme is up to Rs. 30 lakhs.

Also read: SBI Student Loan Scheme | SBI Education Loan

If you liked this article, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

SBI Scholar Loan

Scheme | SBI Education Loan

Your site is very important.

ReplyDeleteThanks for reading.

DeleteEducation Loans has really helped students to fulfill their educational goals in life. Also for more such Blog visit - education loan scheme

ReplyDeleteFinding a new home is tough cause middle-class people can't find an affordable mortgage loan to buy a home, That's why mortgage intelligence is here to help you with finding the best mortgage rate that can help you a lot. Visit our website to get in contact with our agents. Mortgage Agents Oshawa

ReplyDeleteIt's a nice article, Which you have shared here about the student loans. Your article is very informative and I really liked the way you expressed your views in this post. Thank you. Mortgage broker in Gladstone Park

ReplyDeleteThis is amazing and this one is great and helped me alot you can also visit to this link for your personal finance Needs Short term loan

ReplyDelete