Forgot Income Tax e-filing password? Reset it in 5 simple ways

Forgetting the Income Tax e-filing password is a common mistake which many tax payers make as it requires only once in a year for filing income tax return. If you also forgot your password and you are afraid, please do not worry there are multiple ways to reset income tax e-filing password. In this post, let us take a look at the step by step procedure on how to

There are two methods of resetting Income Tax e-filing password which has been explained below.

1. Using Income Tax Website

2. Using NetBanking

Reset Income Tax e-filing password using Income Tax Website

1. Go to the income tax e-filing website: http://incometaxindiaefiling.gov.in/

2. Click on the “Login Here” button.

2. Click on the “Login Here” button.

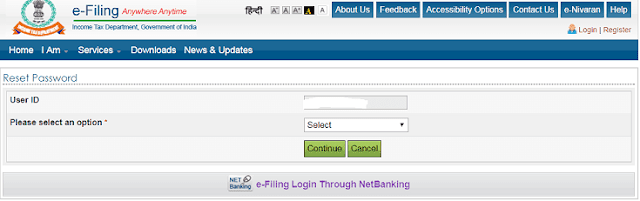

On submitting this, you would be given

four options for recovering your income

tax e-filing password.

1. Answer Secret Question

2. Upload DSC (Digital Signature

Certificate)

3. Using OTP (PINs)

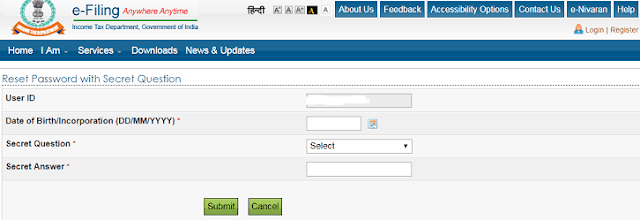

Option 1

Answer Secret Question

In case you select “Answer Secret Question”

option from the drop down menu and click on “Continue” button.

1. Enter the Date of

Birth/Incorporation from the Calendar provided (Mandatory).

2. Select the Secret

Question from the drop down options available (Mandatory).

3. Enter the ‘Secret Answer’

and Click on “Submit”.

4. On success, you must

enter the New Password and confirm the password.

5. Click on “SUBMIT”.

Once the password has been

changed a success message will be displayed. You can log in with new password.

Option 2

Upload DSC (Digital Signature Certificate)

1. You can select any one of the

two options provided: i. New DSC ii. Registered DSC.

2. You must Upload Signature

File generated using DSC Management Utility and click on the “VALIDATE” button.

The DSC is validated.

3. On success, you must

enter the New Password and confirm the password.

4. Click on “SUBMIT”.

5. Once the password has

been changed a success message will be displayed. You can log in with new

password.

Option 3

Using OTP (PINs)

In case you select “Using OTP (PINs)”

option from the drop down menu and click on “Continue” button.

1. You must select one of the

options mentioned below

A) Registered Email ID and

Mobile Number

B) New Email ID and Mobile

Number

Registered

Email ID and Mobile Number

|

New

Email ID and Mobile Number

|

Step

1: Registered Email ID and the Mobile

number will be displayed.

Step

2: Click on “Validate”. PINs would be sent to registered Email ID and Mobile

Number.

Step

3: The user must enter the PINs received to the registered Email ID and

Mobile Number and Click on “VALIDATE”.

Step

4: On success, the user must enter the New Password and confirm the password.

Step

5: Click on “SUBMIT” Step 6: Once the reset password request has been

submitted, a success message will be displayed. The user can login with new password after the time specified in

communication.

|

Step

1: User must enter new Email ID, Mobile number and one of the three options

mentioned below( applicable if the user

has efiled previously) a. 26AS TAN -

The user must TAN of Deductor, as available in 26AS. b. OLTAS CIN – The user

must enter the BSR Code, Challan Date,

and Challan Identification Number (CIN) as available in 26AS. c. Bank Account

No – The user must enter the Bank Account number as mentioned in Income Tax

Return. Note: Please enter the details as per any of the e-Filed returns from

AY 2014-15 onwards.

Step

2: Click on “Validate”. PINs would be sent to entered Email ID and Mobile

Number.

Step

3: The user must enter the PINs received to the provided Email ID and Mobile

Number and Click on “VALIDATE”.

Step

4: On success, the user must enter the New Password and confirm the password.

Step 5: Click on “SUBMIT”

Step

6: Once the reset password request has been submitted, a success message will

be displayed. The user can login with

new password after the time specified in communication.

|

Note:

1. In case, the user has not

received the PINs in a reasonable time, the user

can opt for Resend PINs.

2. An email along with a link

for “Cancellation for the password reset request” will be shared to the

registered Email ID and new Email ID. In case the user identifies the request

for password reset is un-authorized, then

the user can click on the Cancellation

link provided within 12hours. PAN and DOB validation will be done before

aborting the password reset request.

Option 4

Using Aadhaar OTP

Pre-requisite: To generate

Aadhaar OTP, Taxpayer’s PAN and Aadhaar must be linked.

In case you select “Using Aadhaar OTP” option

from the drop down menu and click on “Continue” button.

1. You will be redirected to a

page where you can confirm your Aadhaar Number. Click “Generate Aadhaar OTP”.

2. Aadhaar OTP will be

generated and sent to the Mobile Number registered with Aadhaar. You must enter

the Aadhaar OTP received and click on the “VALIDATE” button. The Aadhaar OTP is

validated.

3. On success, you must

enter the New Password and confirm the password.

4. Click on “SUBMIT”.

5. Once the password has

been changed a success message will be displayed. You can log in with new

password.

Reset Income Tax e-filing password using NetBanking

Registered Taxpayer can log in through NetBanking and reset the

password. The steps are as follows:

1. Go to the income tax e-filing website.

2. Click on the “Login Here” button.

3. Click on “Forget Password?” link.

4. Enter your “User ID”, “Captcha Code”

and click on “Continue” button.

6. Select the Bank from the

list of Banks providing the e-Filing login facility.

7. After login to NetBanking

account, click on the link "Login to the IT e-Filing account"

e-Filing user Dashboard screen shall be displayed.

8. The taxpayer can change the password under Profile settings.

For Example

Reset your Income Tax

e-filing password through HDFC Bank Net-banking.

1. Login to HDFC NetBanking.

List of Banks providing the

e-Filing login facility

1. Allahabad Bank

2. Andhra Bank

3. Axis Bank Ltd

4. Bank of Baroda

5. Bank of India

6. Bank of Maharashtra

7. Canara Bank

8. Central Bank of India

9. City Union Bank Ltd

10. Corporation

Bank-Corporate Banking

11. Corporation Bank-Retail

Banking

12. DENA BANK

13. HDFC Bank

14. ICICI Bank

15. IDBI Bank

16. Indian Bank

17. Indian Overseas Bank

18. Karnataka Bank

19. Kotak Mahindra Bank

20. Oriental Bank of

Commerce

21. Punjab National Bank

22. Punjab and Sind Bank

23. State Bank of Bikaner

and Jaipur

24. State Bank of Hyderabad

25. State Bank of India

26. State Bank of Mysore

27. State Bank of Patiala

28. State Bank of Travancore

29. Syndicate Bank

30. The Karur Vysya Bank Ltd

31. The Federal Bank Limited

32. UCO Bank

33. Union Bank of India

34. United Bank of India

35. Vijaya Bank

36. Yes Bank

Hope

the above mentioned methods will help you in resetting your Income Tax e-filing

password.

You

may also like to read: How to set your financial life in order?

You

may also like to read: Public Provident Fund (PPF)

You

may also like to read: How to teach children about money matters?

You

may also like to read: How to link Aadhaar to EPF account?

If

you liked this article, share it with your friends and colleagues through

social media. Your opinion matters, please share your comments.

Forgot Income Tax e-filing password? Reset it in 5 simple ways

Forgot Income Tax e-filing password? Reset it in 5 simple ways

No comments:

Post a Comment