Linking Aadhaar to EPF account

online is an easy process. You can link your Aadhaar to your PF account or

update your KYC information online using UAN member portal. These details

include Aadhaar number, PAN number, and

your bank account details. In this post, let us take a look at how to link Aadhaar

to PF account or update your KYC details online.

Aadhaar is very important

for all the UAN and EPF related services. Linking of Aadhaar / KYC update in your

PF account can give you many benefits. Therefore, all the EPF members should update

KYC in EPF account.

What is KYC?

KYC means “Know Your

Customer”. It is a process by which banks and financial institutions obtain

proper information about the identity and address of the customers. In this process,

you have to prove your identity and address by producing a copy of identity

proof and address proof. Aadhaar is an important document as it contains

details like your name, your photograph, date of birth and address.

Documents used for KYC at UAN portal

Following documents can be

used for KYC at UAN portal

1. Bank Account Number

2. PAN Card

3. Aadhaar Card

4. Passport

5. Driving License

6. Election Card

7. Ration Card

8. National Population

Register

How to link Aadhaar to EPF account online?

You can easily link your

Aadhaar to EPF account by using the online facility of EPFO. Nowadays, there is

no need to upload a scanned copy of your card, only number and expiry date in

enough. Just follow step by step instructions given below.

1. Go to the EPFO website http://www.epfindia.com

2. Click on the “KYC

Updation (Member)” button in the top right corner of the window.

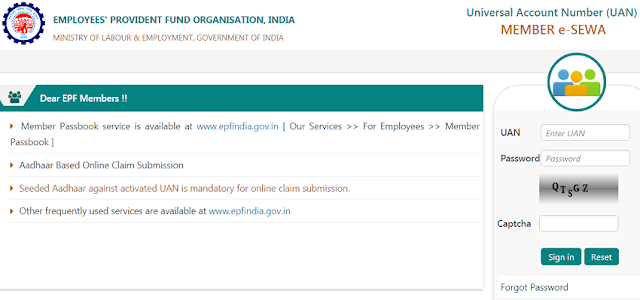

3. Nest screen, you are at

EPFO unified EPF portal.

4. Login to UAN portal using

your UAN number and password.

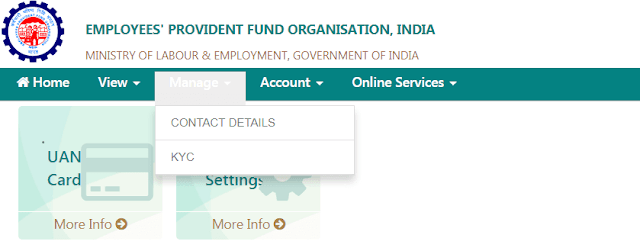

5. Once you logged in, the

screen will look like the below image.

6. Under the “Manage” tab, you will find “CONTACT DETAILS”

and “KYC” in the drop-down menu. Click on it.

7. Here, you will find a

form to update KYC. EPFO has given several options such as Bank Account Number,

PAN Card, Aadhaar, Passport, Driving License, Election Card, Ration Card and

National Population Register.

8. Select the “Aadhaar”

option and enter the Aadhaar number and your name as it is written on your card.

Click on “Save” button. If there is a mismatch in names, then contact your HR

department immediately to resolve the issue.

9. Now you can see it in the

“Pending KYC” section until it is approved by your employer. As you can see in the

image below.

10. This information will be

sent to your employer for approval. Once it is approved, then you can see it in

the “Approved KYC” section. As you can see in the image below.

How to update KYC in EPF account online?

Aadhaar, PAN, and Bank account details are the most important documents required for

completing this process. When you find the form to update KYC while

linking Aadhaar to PF account. At this stage, you can update any of the mentioned documents through this form. Just you need to

enter the document number and name as it is written on your document. However,

along with the bank account number, you also

need to enter the IFSC code of the bank.

Importance of KYC update in EPF

All the EPF members should

update their KYC for EPF UAN. These details include Aadhaar, PAN, and your bank account details. You must

update these details with UAN database as soon as possible. KYC update with UAN

gives the following benefits.

1. KYC updated account does

not face any delay during EPF transfer and withdrawal.

2. At the time of EPF

withdrawal, PAN is mandatory.

3. KYC updated PF account

holders can withdraw EPF online without the attestation of their employer.

4. Your bank account is necessary to get your EPF payments. If you

have updated your correct bank account number then EPFO directly transfers the

money to your account through electronic mode.

5. Aadhaar updation in EPF

account will make it easy to merge your various UAN number into one UAN.

Hope now you can link your Aadhaar to EPF account and

update your KYC information online.

Also read: 10 Tips to use credit card wisely

If you liked this post, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

Hello Sir

ReplyDeleteI worked in a company and left it after 1 year and 6 months. I have my UAN number and PF passbook. How should i withdrawal my PF money from pf account.

bahut achi jankari hai , aur ache se samj b aa skta hai

ReplyDeleteRajasthan GK in Hindi

I have updated my bank details in my KYC section but the same is yet to be verified by the employer because he cant find it. Please advise

ReplyDeleteHello sir, How to Link Aadhar to EPF (UAN) Account through Online

ReplyDeleteI sir my name is radhika Gupte I had applied for online of claim online on 13 Oct but it still showing as under process . please help me in this as I want the money as soon as possible.

ReplyDelete