|

| Image credit: www.aegonlife.com |

Aegon Life iMaximize Insurance

Plan is an investment plus insurance plan to secure your child’s education and

future. Aegon Life iMaximize Insurance Plan is an online ULIP plan with ZERO premium

allocation charge. That feature makes this policy unique and one of the most cost-efficient unit

linked insurance plans. In this post, let's take a look at the features

& benefits of Aegon Life iMaximize Insurance Plan.

Aegon Life iMaximize Insurance Plan

Aegon Life Insurance promotes

Aegon Life iMaximize Insurance Plan with the tagline, “NON-STOP PROTECTION FOR

YOUR LOVED ONES”. The policy has many exciting features and benefits. It provides

you the option for opting the death benefit suitable for you. It comes with a partial

withdrawal facility that gives you the option to withdraw money from your fund value.

The policy can be bought online, and the purchase process is very easy.

What is a ULIP?

A ULIP (Unit Linked Insurance

Plan) is a product offered by insurance companies that give investors the benefits of both insurance and investment under

a single integrated plan. ULIP is a popular financial instrument among

investors due to the advantage of insurance cover along with options to choose

investment avenue.

Key Features of Aegon Life iMaximize Insurance Plan

1. Aegon Life iMaximize

Insurance Plan is an online ULIP plan.

2. No premium allocation

charge under this plan.

3. The plan has short pay

options of 5 pay or 7 pay.

4. You can choose from 6 Unit

linked funds as per your investment objective.

5. Choice of two death benefit

options.

6. You can boost your fund value

through periodic top-ups.

7. Switch your invested

premiums from one fund to another.

8. Withdraw 20% of your

investment after 5 years whenever the need arises.

Benefits of Aegon Life iMaximize Insurance Plan

1. Death Benefits: There are two

options available to the nominee in case of death of the policyholder.

Benefit Option 1: The nominee

receives highest of sum assured or fund value or 105% of all the premiums paid in

case of an unfortunate demise of the life assured. In case a Top-Up fund

exists, higher of top-up sum assured or top-up fund value will also be paid.

The policy terminates thereafter.

Benefit Option 2: The nominee

receives the following benefit in case of an unfortunate demise of the life assured

during the term of the policy.

a) Higher of sum assured or

105% of all premiums paid is immediately paid. b) All the future premiums will

cease.

c) The beneficiary will be

paid an amount equal to the annualized premium

at the start of every policy year following the date of death till the end of the policy term.

d) Total fund value as on the

date of intimation of the death of the life assured will be reallocated to the secure fund. At the end of the policy term, the

total fund value will be paid to the beneficiary.

2. Maturity Benefits: You

receive the total fund value as on the maturity date.

3. Liquidity through Partial Withdrawal: You may need money to fulfill certain urgent goals during the policy term. The partial withdrawal facility that gives you the option to withdraw money from your fund value after first 5 policy years. The maximum amount of partial withdrawal that you can withdraw in any policy year is 20% of the fund value at the beginning of that policy year. You can make up to 4 partial withdrawals in each policy year free of charge.

4. Tax Benefits: The premiums paid and benefits received are eligible for tax benefits under Sec 80C and 10(10D) of the IT Act, 1961.

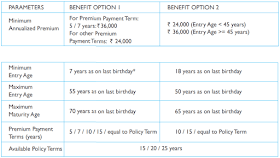

Eligibility for Aegon Life iMaximize Insurance Plan

* The risk cover will start

immediately upon commencement of the Policy

Investment Funds available under Aegon Life iMaximize Insurance Plan

You can choose to invest in

any of the six investment funds available in any proportion as per your investment

objective.

1. Blue Chip Equity Fund

2. Accelerator Fund

3. Opportunity Fund

4. Stable Fund

5. Secure Fund

6. Debt Fund

How to apply for Aegon Life iMaximize Insurance Plan?

Follow the below mentioned simple

steps to apply for Aegon Life iMaximize Insurance Plan online

1. In first step, just choose

the policy term and the premium payment term of your policy.

2. Here you need to decide on

the annual premium you want to pay.

3. Choose you sum assured as

per the amount of insurance cover you need.

4. Invest your premium in

choicest of six investment funds available in any proportion.

Availability

of loan

under this plan

Aegon Life iMaximize Insurance

Plan does not offer a loan.

Click here to know more about this plan.

Also read: HDFC Life Click2Invest ULIP Plan

If you liked this post, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

Nice subject you have chosen.

ReplyDelete